Apple dropped the public beta of iOS 26 in July, just like it said it would. As for the iPhone 17 lineup, it’s still in the works, with the usual September launch window on the horizon. So far, nothing major has landed, and frankly, no one expected it to. This part of the year always feels like the quiet stretch before Apple starts rolling out the headline stuff. But yesterday, July 31, the company decided to shake things up slightly by publishing its Q3 2025 earnings call. Tim Cook and CFO Kevin Parekh hopped on the mic to talk numbers, trends, and why everything, unsurprisingly, is still going very well in Cupertino.

Table of Contents

Just Another Record-Breaking Quarter

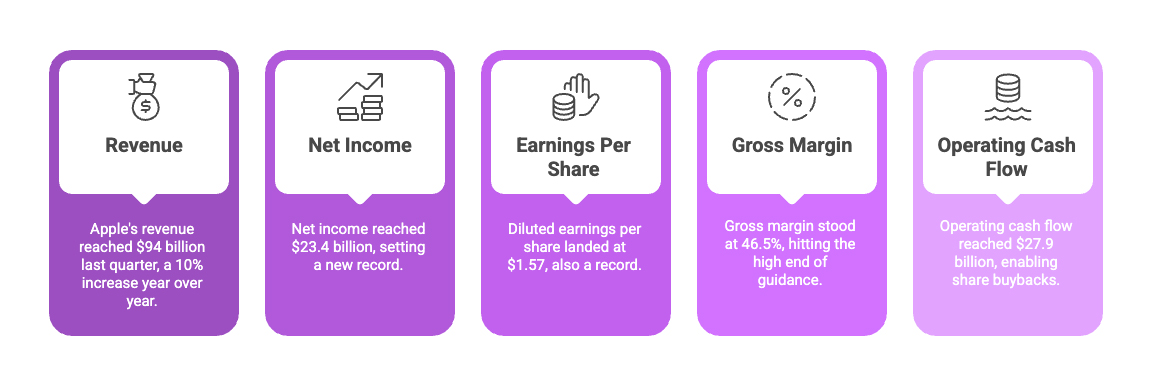

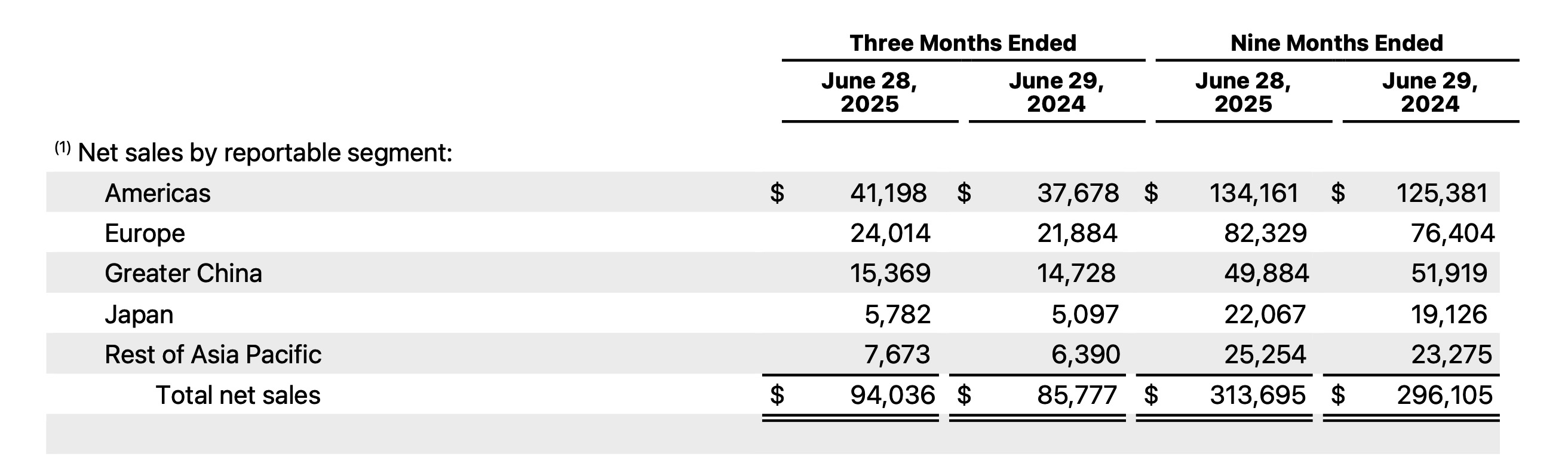

Tim Cook opened the earnings call by flexing the obvious: Apple pulled in $94 billion in revenue last quarter. That’s a 10% jump year over year and a new June quarter record. Because apparently, the ceiling keeps moving higher. Net income hit $23.4 billion, and diluted earnings per share landed at $1.57, also a record.

Cook called the results “better than we expected,” which sounds modest until you remember Apple basically never misses. He credited the boost to “double-digit growth across iPhone, Mac, and Services,” plus strength in almost every major market, including Greater China, India, and Brazil. Apparently, people everywhere still find a reason to upgrade their phone or laptop in the middle of the year.

CFO Kevin Parekh chimed in with more numbers. Gross margin stood at 46.5%, which, according to him, “hit the high end of our guidance.” He also pointed out that operating cash flow reached $27.9 billion. If you’re keeping score, that’s the kind of figure that lets a company drop $27 billion on share buybacks and dividends without blinking.

And in case you’re wondering if all this success came with a side of government-induced pain – yes, it did. Apple paid around $800 million in tariffs during the quarter. But somehow, they still managed to report record results.

So yes, everything went up. And if anyone thought Apple might slow down while gearing up for the iPhone 17 launch, the Q3 scoreboard says otherwise.

A Look Inside the Product Lines

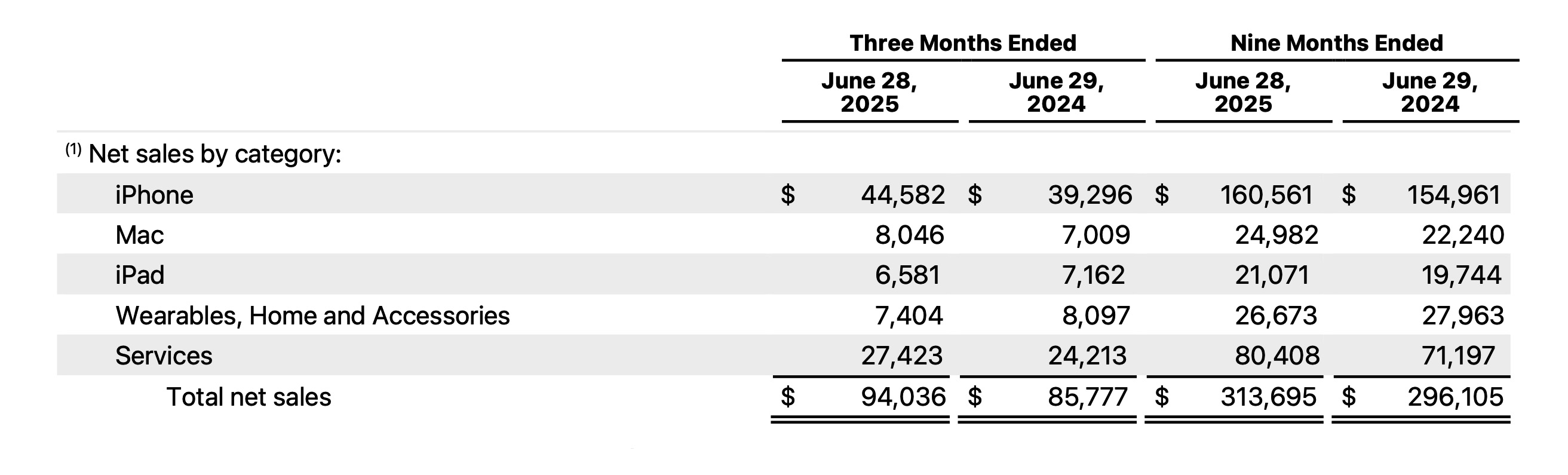

If Apple brought in $94 billion last quarter, it didn’t do it by selling USB cables. Most of that mountain of revenue came from the usual devices ( iPhones, Macs, Services) and, as always, some products pulled more than their weight. Looking at the product breakdown explains why Apple keeps breaking records, even in what’s supposed to be its “quiet” quarter. And yes, they threw in a few humblebrags along the way.

- The iPhone remained the heavyweight, pulling in $44.6 billion, up 13% year over year. The iPhone 16 family clearly clicked with buyers. Tim Cook pointed to “strong performance in every geographic segment” and highlighted growth in emerging markets like India and Brazil. Cook also mentioned Apple hit a milestone no other smartphone company on Earth can touch:

3 billion iPhones sold!

Thank you to everyone who’s made iPhone such an important part of their lives. I’m incredibly excited for what’s ahead!

— Greg Joswiak (@gregjoz) July 31, 2025

- Mac revenue reached $8 billion, a 15% increase. The M4 MacBook Air led the charge, and Apple claimed a record number of Mac upgraders. According to Kevin Parekh, that bump wasn’t isolated, they grew in every geographic segment and saw double-digit growth in Europe, Greater China, and the rest of Asia Pacific.

Source: YouTube video by zollotech - iPad didn’t follow the same trajectory. Revenue dropped 8%, ending at $6.6 billion. Apple blamed the decline on a tough comparison to last year’s iPad Pro and Air launches. But not everything looked grim. Parekh pointed out that the product still pulled in new users:

- Wearables, Home, and Accessories segment brought in $7.4 billion, down about 9% year over year. The decline? Apple blamed it on accessories that launched last year and made 2024 hard to beat. But within the category, Apple Watch showed signs of life.

- Services hit $27.4 billion, rising 13% and setting, you guessed it, another all-time record. The App Store, iCloud, and Apple TV+ all contributed. Parekh added that paid subscriptions across Apple platforms now top one billion.

Source: Report on the Apple website

Beyond products, Apple made sure everyone noticed a few software wins. Cook called out a stat that might sound dull unless you’re a developer:

Also worth noting that TV+ earned 81 Emmy nominations, VisionOS got smarter, and retail expansion reached Saudi Arabia, India, and Japan.

In case anyone wondered whether Apple only sold devices in North America, not even close. They grew revenue in every region. Japan saw a 13% increase. The rest of Asia Pacific jumped 20%. Even Greater China, which has been a question mark lately, edged up 4%.

Apple’s Outlook for Q4 2025

In addition to reviewing the results from Q3, Tim Cook and CFO Kevin Parekh also shared what the company expects heading into the September quarter. They don’t make bold predictions and prefer carefully crafted optimism. Here are the key points we picked out:

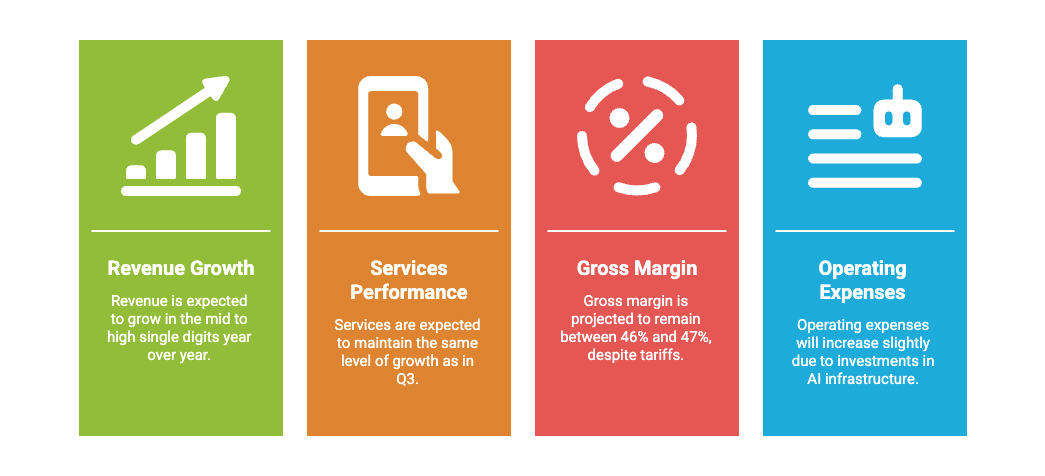

- For Q4 2025, the company expects revenue to grow in the mid to high single digits year over year. No specific number, of course. Just enough to reassure investors without locking into anything too ambitious. Classic Apple.

- Services, as always, will do the heavy lifting. After pulling in $27.4 billion in Q3, Apple expects that same level of growth to continue through the September quarter.

- Gross margin should stay between 46% and 47%, even with a nice little $1.1 billion tariff bill arriving in Q4. That’s just the price of doing business now, and Apple seems fine with it. Because why complain when you’re still making more profit than some countries.

- Operating expenses will increase slightly, with Apple pouring more money into AI infrastructure. They didn’t give exact figures for those plans, but made it clear that this isn’t about experiments anymore, they’re going all in. Siri might finally stop acting like it’s stuck in 2018.

Overall, the tone was steady: business looks good, margins remain strong, and Apple is preparing for its usual fall blockbuster. If something breaks the script, it won’t come from Cupertino.

Final Thoughts

It’s hard to give this news any sweeping opinion, as we’re not talking about leaks or rumors here, just numbers. But those numbers clearly show that Apple continues to hold its position in the market with full confidence. Despite the usual online grumbling about the disaster that was iPhone 16 or the hideous mess that is iOS 26, the company just posted one of its best June quarters ever. The numbers don’t care about Reddit threads or YouTube rants – they tell a very different story. And frankly, we’re happy about that.

Apple looks as stable as ever, breaking records, pushing software, and prepping for its fall releases without a hint of panic. Now all that’s left is to hope nothing unexpected happens to the global economy, because at this point, that’s probably the only thing that could shake Apple’s position, even slightly.