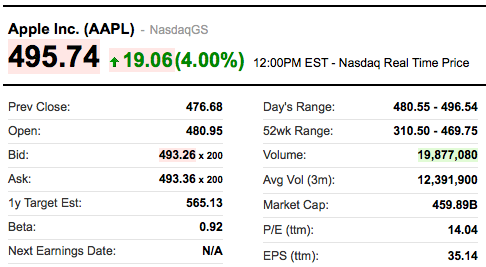

Not only has Apple been making insanely high profits, but the stock market has been paying attention. The AAPL stock has continued upward at such a fast rate, it is now valued at a price more than Google and Microsoft combined.

At its current $460 billion market capitalization, Apple is worth more than 10% of all NASDAQ combined. More impressive maybe is that Apple is worth 52 times RIM’s value, more than 5 times Amazon’s, more than twice the value of Google, and almost double the size of Microsoft. Heck, Apple is worth more than Google and Microsoft combined!

Even for those of us who aren’t AAPL shareholders, this is very good news. Apple has shown that it can consistently deliver the goods and break all sorts of records, and finally the stock market is starting to catch on. For those of you who invested in Apple stock in January of 2009, today you would have a six-fold growth in your investment. That’s an insane growth from a company who has been around since the dawn of personal computers.

That said, there are a number of investors that believe that Apple should be giving dividends to their investors. Clearly, Apple isn’t doing that. It has a massive reserve of cash, and it isn’t afraid to let it grow. On the upside, that does allow them to make huge investments in things like battery and storage technology that keeps their costs down and their profits high.

What do you think about this? Should a company as profitable as Apple be passing on the cash to investors, or is Apple’s plan solid? Sound off in the comment section below this post. This is a hot-button topic, and we want to know how the community feels about this.

Source: iDownloadBlog