If you use Apple Card, this post is for you. Yesterday, January 7, 2026, Apple officially confirmed that JPMorgan Chase will become the new issuing bank for Apple Card, replacing Goldman Sachs after almost seven years. Here we’ll try to explain why Apple decided to make this switch, what it actually means for you as an Apple Card user, and whether you need to do anything at all to avoid losing money.

What Changes for Apple Card Users and Whether You Need to Do Anything?

Let’s start with the question everyone asks first: does anything change for you right now, and do you need to take action? Apple’s answer is simple and surprisingly calm for a financial transition of this size – no.

Apple says the transition to the new issuing bank will take about 24 months. During this period, you can keep using your Apple Card exactly the same way you do today.

Apple also addressed several practical questions that you usually worry about in situations like this:

- You do not need to apply for Apple Card again. Your existing account remains valid.

- Mastercard stays in place as the payment network, so acceptance does not change.

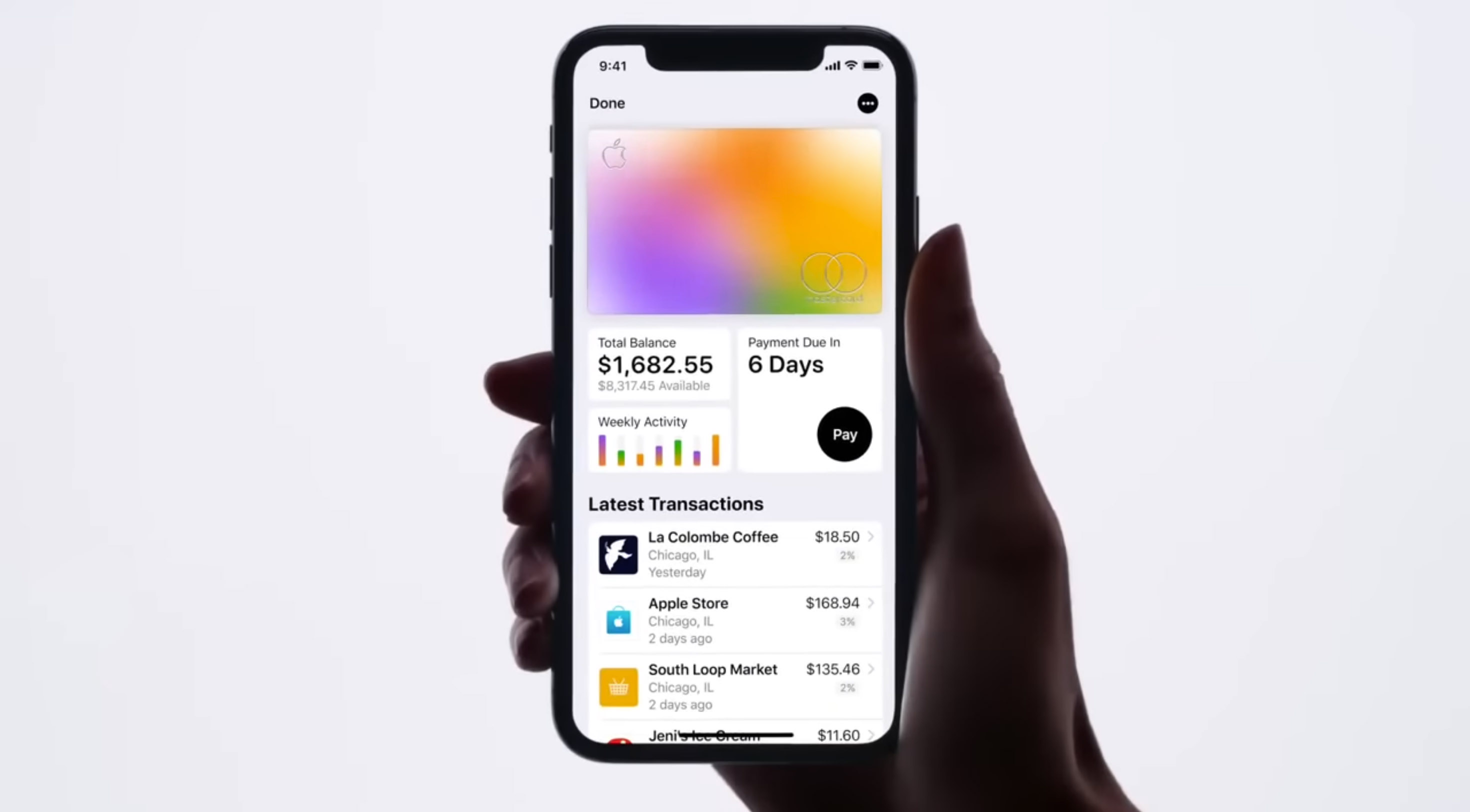

- You continue to manage your Apple Card inside the Wallet app, just like before.

- Your physical Apple Card keeps working as usual. No replacement required.

- Apple Card support remains available through the Wallet app and Apple’s support site. Goldman Sachs will continue to handle support until the transition ends.

- Apple says its privacy and security standards stay the same, and Apple works with both banks to transfer account data securely.

For now, this is the full picture Apple shares. There are no forms to fill out, no buttons to press, and no deadlines to mark on your calendar. Your only real task is to keep the transition in mind and keep using your Apple Card as you normally do. Apple promises to communicate future steps clearly when the moment arrives.

Why Apple Is Switching From Goldman Sachs to Chase?

Apple did not wake up one morning and decide to swap banks just to keep things exciting. This story started years ago, and it slowly moved toward this outcome.

When Apple launched Apple Card in 2019, the choice of Goldman Sachs raised eyebrows even back then. Goldman Sachs had a strong name on Wall Street, but almost no experience with mass-market consumer credit cards. Apple wanted full control over design, messaging, onboarding, and user experience. Goldman wanted a fast way into consumer banking. On paper, both sides got what they wanted.

In practice, the partnership never felt fully comfortable. Over the years, reports began to show that Apple Card did not fit well inside Goldman’s traditional business model. Apple pushed for wide approval ranges, simple rules, and a very “Apple” tone toward users. Goldman had to handle credit risk, customer disputes, and regulatory oversight at a scale it had rarely faced before. Losses in Goldman’s consumer division grew, and Apple Card often appeared near the center of that discussion.

By 2023, the situation became more public. Goldman openly signaled that it wanted to reduce its exposure to consumer banking. Around the same time, reports confirmed that Apple had already started talks with other banks.

Apple is pulling the plug on its Apple Card partnership with Goldman https://t.co/yVZJnBWxZp

— Aaron Tilley (@aatilley) November 28, 2023

So why JPMorgan Chase? Chase plays in a completely different league when it comes to consumer finance. It runs one of the largest credit card businesses in the United States. It manages risk at a massive scale. It operates co-branded cards, loyalty programs, and long-term consumer products as its daily routine, not as an experiment.

From Apple’s perspective, this matters a lot. Apple does not want to become a bank. It wants financial products to feel native to its ecosystem, stable over time, and boring in the best possible way. Goldman brought flexibility but lacked depth in this specific area. Chase brings depth, infrastructure, and experience (even if it brings a more traditional banking mindset along with it).

Final Thoughts

At this point, there is not much left to decode. Apple shared the core facts, answered the obvious questions, and then politely asked everyone to stay calm. For now, that is enough.

Usually, this is the part where we share an opinion. This time, we honestly do not have one. We are not experts in banks and credit systems. From a user’s point of view, there is no alternative path here anyway. If you want to keep using Apple Card, you follow the transition. So we go with the flow. Apple picked a new partner, promised stability, and gave itself two years to move everything carefully. That sounds reasonable, even by Apple standards. We assume this change exists for a reason, and we trust Apple would not risk its brand on a move that makes things worse for users.

For now, the best advice is to use your Apple Card as before and wait for updates. When Apple shares new details, we will read them, overanalyze them, and probably still end up doing exactly what Apple suggests.